Chances are, you'd rather spend your money on college than on taxes. At College SAVE, we get that. That’s why our 529 plan offers tax advantages not provided by other college saving vehicles.

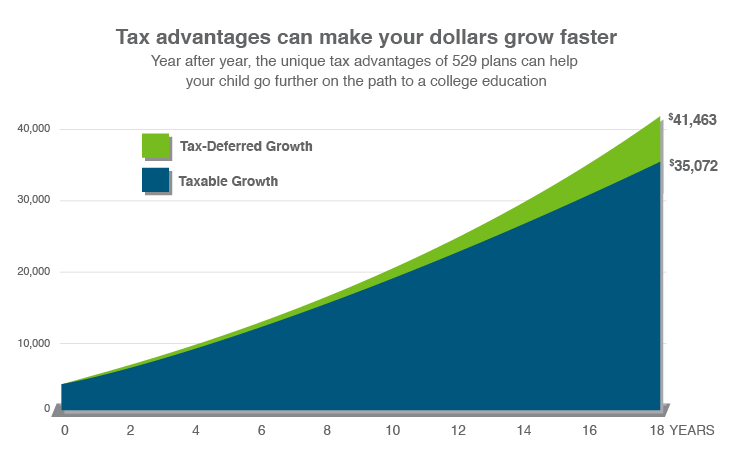

With a 529 account, your savings has the potential to grow at a faster rate than if you had invested in a comparable taxable account. That's because, unlike a conventional investment, your 529 plan grows federal and state tax deferred.

Assumptions: $2,500 initial investment with subsequent monthly investments of $100 for a period of 18 years; annual rate of return on investment of 5% and no funds withdrawn during the time period specified; taxpayer is in the 30% federal income tax bracket for all options at the time of contributions and distribution. This hypothetical is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or any taxes that may be payable upon non-qualified distribution.

When your child reaches college age, withdrawals for qualified higher education expenses are free from federal and state income tax. That way, more of your savings goes toward paying for college rather than taxes.1

Learn more about qualified withdrawals here.

Are you a North Dakota taxpayer? Then you can deduct up to $5,000 (up to $10,000 for married couples) of your College SAVE Plan contributions from your North Dakota state taxable income.3

You can contribute up to $19,000 (up to $38,000 for married couples) per designated beneficiary each year, without incurring federal gift tax consequences. You can even contribute up to $95,000 per designated beneficiary in a single year (up to $190,000 for married couples) by taking advantage of five years' worth of federal tax-free gifts at one time.2

1Earnings on non-qualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.

2The gift will be prorated over five years. In the event the donor does not survive the five-year period, a prorated amount will revert back to the donor's taxable estate.

3Rollovers from another state's 529 plan are not eligible for the state income tax deduction.

Ascensus Broker Dealer Services is the distributor of the North Dakota College SAVE plan, Learn more about Ascensus Broker Dealer Services, LLC on FINRA's BrokerCheck.

For more information about North Dakota's College SAVE Plan (College SAVE), call 1-866-SAVE-529 (1-866-728-3529) or click here to obtain a Plan Disclosure Statement. Investment objectives, risks, charges, expenses, and other important information are included in the Plan Disclosure Statement; read and consider it carefully before investing. Ascensus Broker Dealer Services, LLC (ABD) is Distributor of the College Save.

Please Note: Before you invest, consider whether your or the beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state’s qualified tuition program. You should also consult your financial, tax, or other advisor to learn more about how state-based benefits (or any limitations) would apply to your specific circumstances. You also may wish to contact directly your home state’s 529 college savings plan(s), or any other 529 plan, to learn more about those plans’ features, benefits, and limitations. Keep in mind that state-based benefits should be one of many appropriately weighted factors to be considered when making an investment decision.

College SAVE is a 529 plan established by the State of North Dakota. Bank of North Dakota (Bank) acts as trustee of College SAVE Trust, a North Dakota Trust, and is responsible for administering College SAVE Trust and College SAVE. ABD, the Plan Manager, and its affiliates, have overall responsibility for the day-to-day operations of the Plan, including recordkeeping and marketing. The Vanguard Group, Inc. (Vanguard) provides underlying investments for the Plan. The College SAVE's Portfolios, although they invest in mutual funds, are not mutual funds. Units of the Portfolios are municipal securities and the value of units will vary with market conditions.

Investment returns are not guaranteed and you could lose money by investing in College SAVE. Participants assume all investment risks, including the potential for loss of principal, as well as responsibility for any federal and state consequences.

Not FDIC Insured. No Bank, State or Federal Guarantee. May Lose Value.

Vanguard and the ship logo are trademarks of The Vanguard Group, Inc. Upromise is a registered service mark of Upromise, Inc. All other marks are the exclusive property of their respective owners. Used with permission.