When your child is ready for college, a 529 plan can help you be ready, too. The name "529" refers to the Internal Revenue Code section that discusses this type of college savings tool.

Most 529 plans are sponsored by individual states. To encourage their residents to save for college, many 529 plans offer significant tax incentives. For example, the College SAVE Plan, sponsored by North Dakota, offers a state tax deduction of up to $5,000 ($10,000 if married, filing jointly) to North Dakota taxpayers.

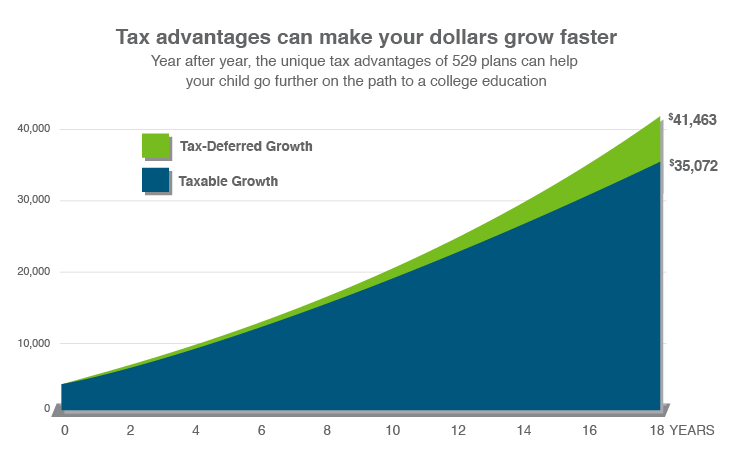

Tax-deferred earnings: In a 529 plan, your assets’ potential growth can be tax-deferred (which means that the earnings on your contributions can accumulate federal and state tax-free), so more of your savings can go toward paying for college instead of paying taxes.

Assumptions: $2,500 initial investment with subsequent monthly investments of $100 for a period of 18 years; annual rate of return on investment of 5% and no funds withdrawn during the time period specified; taxpayer is in the 30% federal income tax bracket for all options at the time of contributions and distribution. This hypothetical is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or any taxes payable upon non-qualified distribution.

Tax-free withdrawals: When you're ready to use a 529, all withdrawals for qualified education expenses are federal and state tax free.1 Learn more about qualified withdrawals here.

Managed portfolios: Contributions to a College SAVE 529 Plan are invested in professionally managed portfolios, options include target enrollment portfolios that automatically adjust their investment based on the year the beneficiary is expected to enter their education program.

Account control: The account owner controls how and when the 529 funds are used, not the designated beneficiary.

Worldwide use: 529 savings can be used at any eligible 2 - or 4 -year college, university, vocational school, technical institute, K-12 school, qualified postsecondary credential or registered apprenticeship program anywhere in the U.S. or abroad, not just those in North Dakota.2

Flexibility of beneficiaries: Anyone with a Social Security number or taxpayer identification number can be a 529 designated beneficiary. That means a child, grandchild, niece, nephew, even yourself. In fact, if your designated beneficiary doesn’t attend school, you can use the funds for an eligible family member.3

Less impact on financial aid than other college savings vehicles. If the student is a dependent, your 529 savings are considered parental assets - which are generally weighted less when calculating Estimated Family Contribution (EFC). In addition, 529 accounts held by grandparents are no longer counted in the EFC formula for federal financial aid purposes. See our Frequently Asked Questions for details. For more about financial aid eligibility, contact a financial advisor, as well as the schools you’re considering.

Use College SAVE 529 assets to pay K–12 expenses. Qualified expenses include certain costs in connection with enrollment or attendance at an elementary or secondary public, private, or religious school other than just tuition. The annual distribution limit is $10,000 per student per year, increasing to $20,000 per student per year beginning in 2026. See the Qualified Withdrawals page for more details.

529 plans can be rolled over to ABLE plans. Federal legislation now allows rollovers from 529 plans to Achieving a Better Life Experience (ABLE) accounts for the benefit of the same beneficiary or a member of the family of the beneficiary without incurring federal taxes up to the annual ABLE contribution limit. North Dakota allows for rollovers of College SAVE 529 assets to ABLE accounts without incurring North Dakota state taxes.4

Rollover to a Roth IRA. 529 account owners may rollover savings from their 529 plan account into a Roth IRA without incurring any federal income tax or penalty. The Roth IRA must belong to the same beneficiary, and the lifetime rollover limit is $35,000. To be eligible, the 529 account must have been open for at least 15 years and the rollover amount must have been in the 529 account for 5 years. 529 to Roth IRA rollovers will also count toward annual Roth IRA contribution limits, but Roth IRA income limits do not apply for this type of contribution. For more information, please read the Plan Disclosure Statement.

1Earnings on non-qualified distributions may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.

2An eligible institution is one that is eligible for federal financial aid programs.

3For designated beneficiary changes to occur without federal or state income taxes, the new designated beneficiary must be a Member of the Family of the former designated beneficiary.

4Rollovers must be reinvested into an ABLE Plan within sixty (60) days of the withdrawal date. A Rollover for the same Beneficiary is restricted to once per 12-month period. Rollovers into ABLE Plan accounts are subject to the annual contribution limits for ABLE Plan accounts. A member of the family of a beneficiary means an individual as defined in Section 529(e)(2) of the Internal Revenue Code, as amended. Generally, this definition includes a beneficiary’s immediate family members such as a child or stepchild; a sibling, stepsibling, or half sibling; a parent, or stepparent; a grandparent; a grandchild; a niece or nephew; an aunt or uncle; a first cousin; a mother- or father-in-law, son- or daughter-in-law, brother or sister-in-law; or a spouse of any of the previous individuals, except first cousin.

This website contains links to other websites as a convenience to users. Neither the Plan, the State of North Dakota, Bank of North Dakota, nor Ascensus, Vanguard nor their respective affiliates, endorses or takes any responsibility for such websites or for any information contained therein, except, in each case, with respect to their own websites.

Ascensus Broker Dealer Services is the distributor of the North Dakota College SAVE plan, Learn more about Ascensus Broker Dealer Services, LLC on FINRA's BrokerCheck.

For more information about North Dakota's College SAVE Plan (College SAVE), call 1-866-SAVE-529 (1-866-728-3529) or click here to obtain a Plan Disclosure Statement. Investment objectives, risks, charges, expenses, and other important information are included in the Plan Disclosure Statement; read and consider it carefully before investing. Ascensus Broker Dealer Services, LLC (ABD) is Distributor of the College Save.

Please Note: Before you invest, consider whether your or the beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state’s qualified tuition program. You should also consult your financial, tax, or other advisor to learn more about how state-based benefits (or any limitations) would apply to your specific circumstances. You also may wish to contact directly your home state’s 529 college savings plan(s), or any other 529 plan, to learn more about those plans’ features, benefits, and limitations. Keep in mind that state-based benefits should be one of many appropriately weighted factors to be considered when making an investment decision.

College SAVE is a 529 plan established by the State of North Dakota. Bank of North Dakota (Bank) acts as trustee of College SAVE Trust, a North Dakota Trust, and is responsible for administering College SAVE Trust and College SAVE. ABD, the Plan Manager, and its affiliates, have overall responsibility for the day-to-day operations of the Plan, including recordkeeping and marketing. The Vanguard Group, Inc. (Vanguard) provides underlying investments for the Plan. The College SAVE's Portfolios, although they invest in mutual funds, are not mutual funds. Units of the Portfolios are municipal securities and the value of units will vary with market conditions.

Investment returns are not guaranteed and you could lose money by investing in College SAVE. Participants assume all investment risks, including the potential for loss of principal, as well as responsibility for any federal and state consequences.

Not FDIC Insured. No Bank, State or Federal Guarantee. May Lose Value.

Vanguard and the ship logo are trademarks of The Vanguard Group, Inc. Upromise is a registered service mark of Upromise, Inc. All other marks are the exclusive property of their respective owners. Used with permission.